fixed deposit interest tax exemption malaysia

True Final tax on interest covers only interest income from banks and trust funds 2. Must contain at least 4 different symbols.

WTOP delivers the latest news traffic and weather information to the Washington DC.

. Interest income received on certain qualified private activity bonds generally is exempt from federal income tax. When company is deemed to be assessee in default. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms.

Interest gained from bank fixed deposit is tax exempted. 150000 Fixed Deposit accounts are available in almost all banks and financial institutions. Interest payable for nonpayment of tax.

13 joint venture means an enterprise carried on by two or more persons in common otherwise than as a partnership. LUMP-SUM TAXATION -- The tax laws of some countries allow the tax authorities to levy a fixed amount of taxes on income in certain circumstances which deviates from. 15 lakh under Section 80C of the Income Tax Act 1961.

The PPF interest rate has remained constant since April 2020 till date at 71. The depositors can also claim the income tax exemptions worth Rs. The portfolio interest exemption does not apply to bank loans made in the ordinary course of business.

PPF interest rate is currently compounded at 71 annually. An application for the tax exemption can be submitted to Talent Corporation Malaysia Berhad from 1 January 2018 to 31 December 2023. True They are considered deposits substitutes 5.

Interest payable for nonpayment of tax by domestic companies. Withholding tax on interest is levied on residents at the rate of 5 percent for a fixed-term deposit with a tenure of at least 90 days or 15 percent. Yes I will continue to pay US federal income tax filed by our CPA in the US.

This is effected under Palestinian ownership and in accordance with the best European and international standards. The income tax slabs and rates have been kept unchanged since financial year FY 2020-21. In the case of Fixed Deposits and Cash Certificates applicable TDS will be deducted from the interest credited to operative account term deposit periodically.

For FY 2021-22 and 2022-23 individual taxpayers will continue to choose between two tax regimes - the existing or old tax regime and. 6 to 30 characters long. Walmart has a cordless vacuum perfect for cars for less than 20 right now.

Islamic banking Islamic finance Arabic. On June 2 the President approved amendments to the Tax Code providing tax benefits to businesses affected by the COVID pandemicAzN 012 bn or 02 percent of GDP. Nonresident investors however are currently exempt from withholding tax on interest.

If a tax treaty between the United States and the foreign individuals payees country of residence provides an exemption from or a reduced rate of withholding for certain items of income the payee should notify the payor of the income the withholding agent of the payees foreign status to claim the benefits of the treaty. Thank you Peter. After a period of one year participant who fulfills the fixed deposit criterion can withdraw up to rm5000000 for approved expenses relating to house purchase education for children in malaysia and medical purposes.

A map of the British. Tax on distributed income to unit holders. False Final tax applies only on identified passive income from sources WITHIN 4.

Exemption from Tax. Income tax means income tax imposed as such by this Act as assessed under this Act but does not include dividend withholding tax or salary or wages tax and includes specific gains tax. Interest is credited on the deposit by the Inland Revenue.

Open a fixed deposit account of rm15000000. Which Bank Is Best for Fixed Deposit 2022. Tax on distributed income to shareholders.

Fixed Term Deposit Childrens savings Online Bonus Saver. The interest rate paid on fixed deposits. With high and guaranteed interest rates the minimal risk involved and tax benefits up to Rs.

Then everyone living in the now-claimed territory became a part of an English colony. I also understand that I will need to open a personal account at Bangkok Bank and transfer into it 400K from our joint account 2 months before applying for a one year visa extension based on marriage after coming to Thailand on a Non-Immigrant 0. Interest payable for nonpayment of tax by company.

This enables a business enterprise to issue the bonds at a lower interest rate. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. False Passive income are generally subject to final tax but not ALL 6.

ASCII characters only characters found on a standard US keyboard. مصرفية إسلامية or Sharia-compliant finance is banking or financing activity that complies with Sharia Islamic law and its practical application through the development of Islamic economicsSome of the modes of Islamic bankingfinance include Mudarabah profit-sharing and loss-bearing Wadiah safekeeping Musharaka joint venture. The amendments grant a one-year exemption from land and property tax to selected sectors including tourism passenger road transportation and cultural facilities.

Persons wishing to obtain employment visas should apply directly to. Parents can join under a long-term visa. There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022-23 in Union Budget 2022.

However these exemptions are available only for the. The British men in the business of colonizing the North American continent were so sure they owned whatever land they land on yes thats from Pocahontas they established new colonies by simply drawing lines on a map. The Act preserves this exemption but repeals the interest exemption for advance refunding bonds issued after 2017.

Fixed deposits are considered to be one of the safest options of investments available in India. Participants are not allowed to work or be employed while staying in Malaysia. If you are filing a petition for denial of a timely filed homestead exemption or denial of tax deferral petition must be filed on or before July 31st of the current tax year You can demonstrate by an appropriate certificate issued by the Department of Children and Family Services and submitted with the petition that you are an eligible.

The interest rates for the PPF deposits are not like those of FDs or Fixed Deposits. See todays top stories. Remittances of foreign-source income into Malaysia by tax residents of Malaysia are not subject to Malaysian income tax.

Nonresident withholding tax on royalties is levied at the rate of 15 percent. Income tax will be deducted as per the law applicable and if the depositors total income including the interest earned on deposit does not come under the purview of income tax 15H. While the fixed deposit interest rates do not vary the interest rate for the PPF deposits varies for each consecutive year.

Show proof of receiving pension from government rm10000 per month.

Fixed Deposit Interest Tax Exemption Malaysia Maximilliandsx

Crypto Tax Free Countries 2022 Koinly

Fixed Deposit Fd Interest Rates Latest Returns Offered By Sbi Hdfc Bank Icici Bank Yes Bank Canara Bank

Bank Fixed Deposit To Serve As A Tax Saving Tool Comparepolicy Com

Taxation On Bank Fixed Deposit Yadnya Investment Academy

Fixed Deposit Account Fixed Deposit Maybank Malaysia

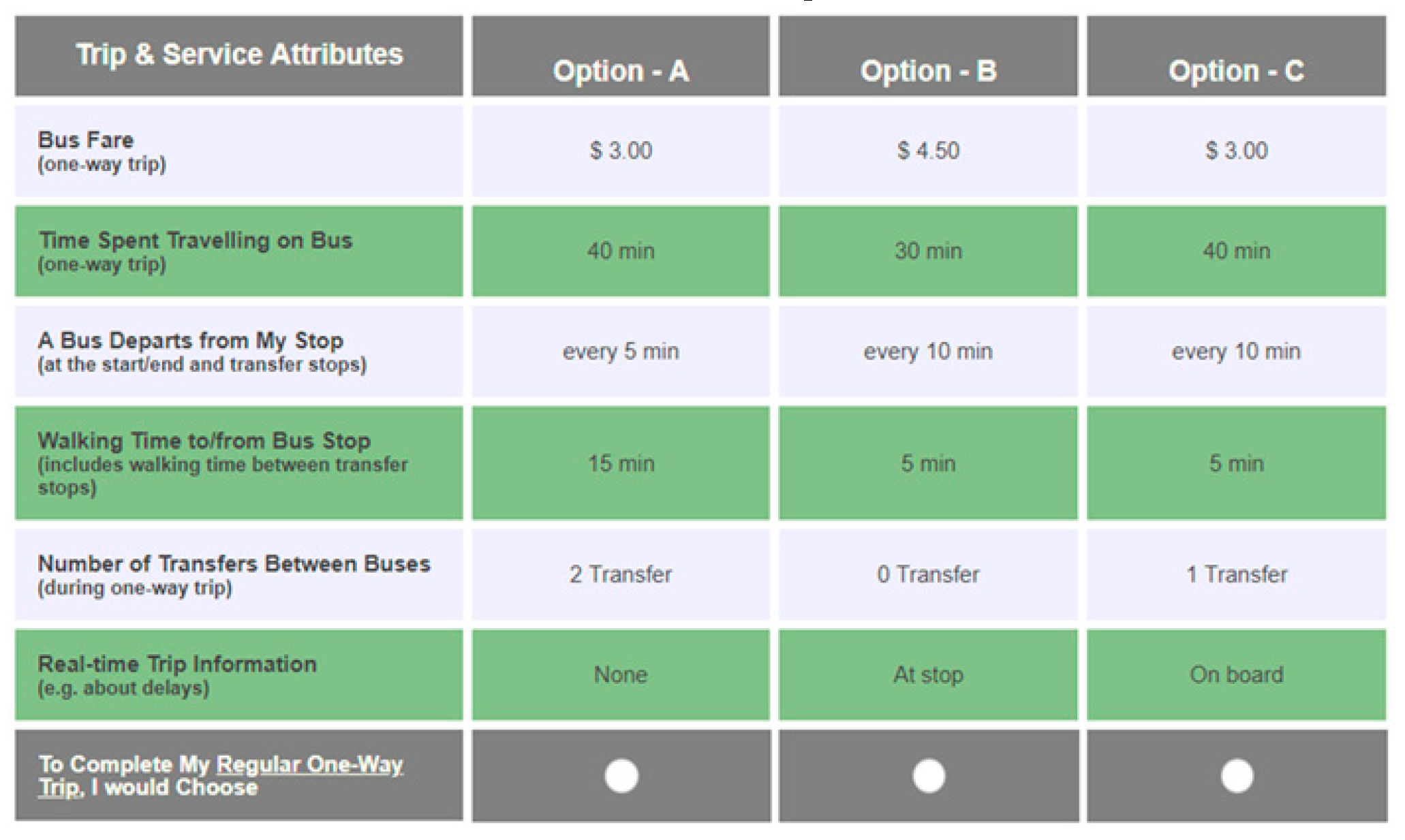

Sustainability Free Full Text Understanding The Transit Market A Persona Based Approach For Preferences Quantification Html

2021 Best 10 Fixed Deposit Accounts In Malaysia Wise Formerly Transferwise

Visa And Residence In Malaysia International Living Countries

Australia Deposit Interest Rate Statista

Is Interest Income Taxable 2021 Tax Rates Examples Tax Strategies

Fixed Deposits Tax Saving Fd For Sec 80c Deductions Benefits Interest Rates Risks Limits

What Is Fcnr Deposit Fcnr Deposit Account Fcnr Interest Rates

Fixed Deposit Rates From 18 Banks Around Malaysia For Your Long Term Saving Everydayonsales Com News

How Interest Income From Fixed Deposits And Savings Accounts Is Taxed

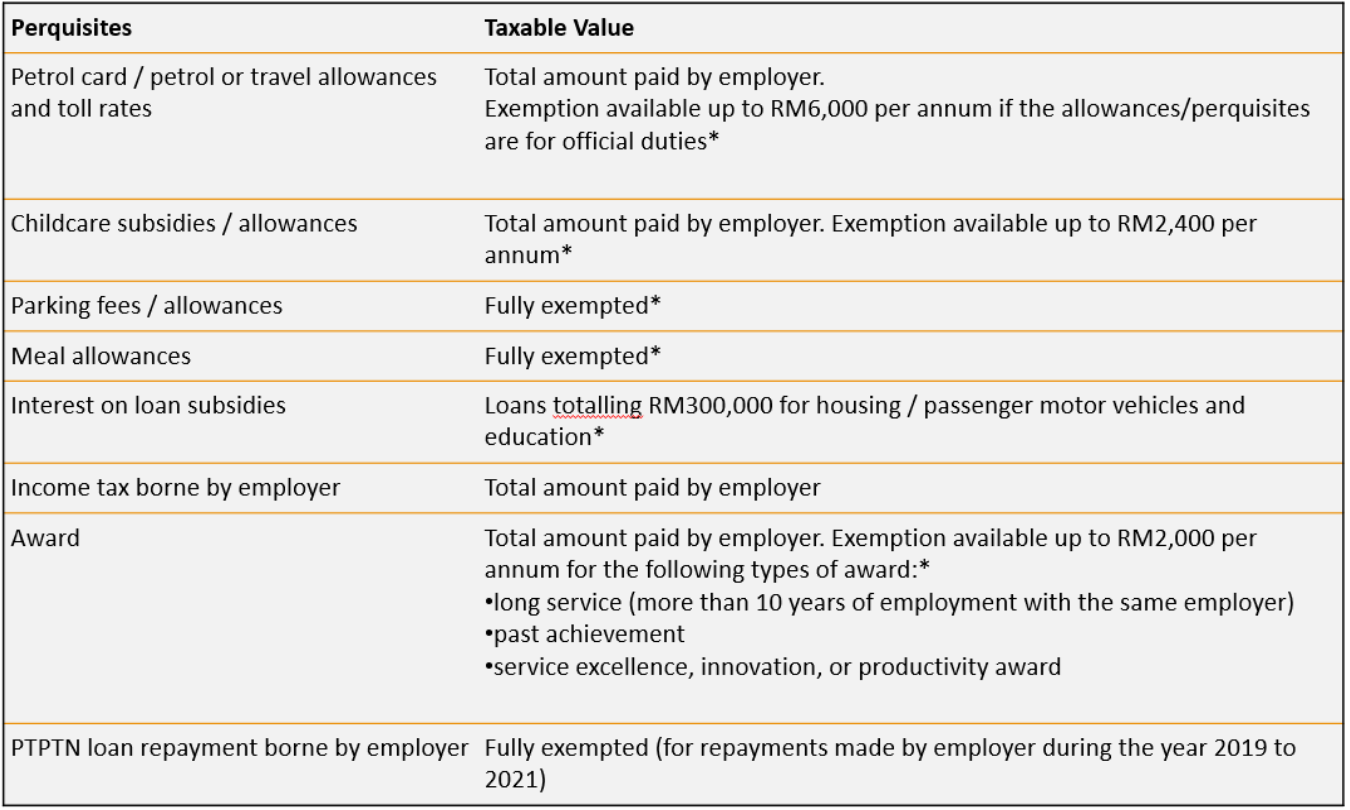

Everything You Need To Know About Running Payroll In Malaysia

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

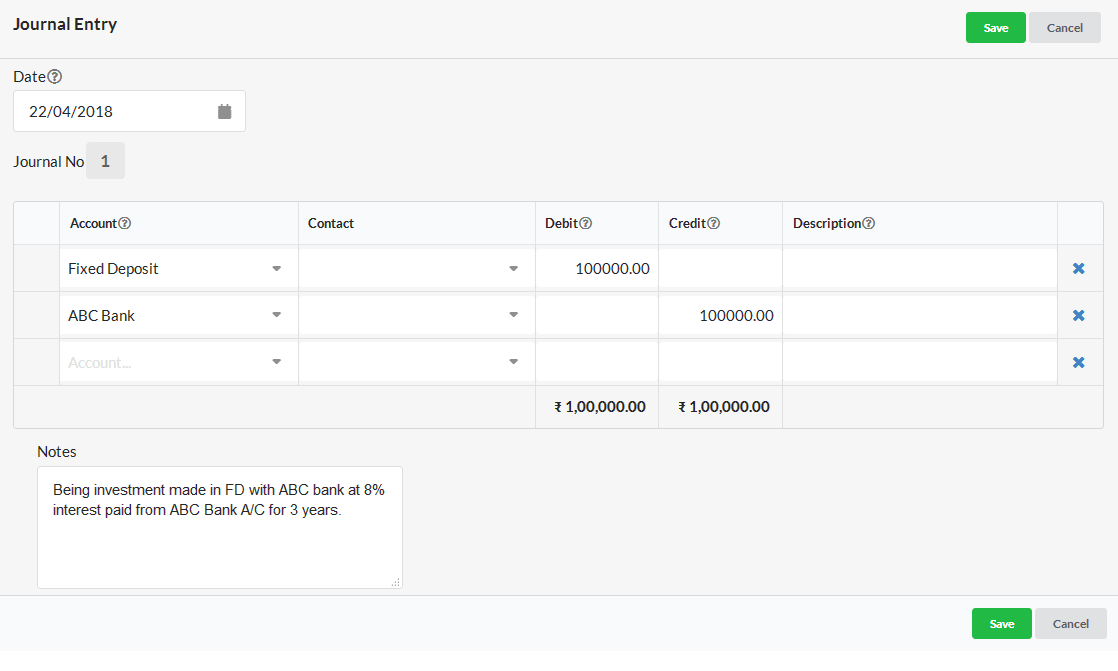

Journal Entry Of Fixed Deposits Output Books Gst Billing Software

Malaysia Income Tax Guide 2016

:max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

0 Response to "fixed deposit interest tax exemption malaysia"

Post a Comment